Author’s Note: I know what you’re thinking, and no, AI did not write this letter. As much as we use AI in our businesses (more on that later), I’m still a liberal arts English major who likes to write!

Estimated reading time: 6–8 minutes.

Clients, Colleagues, Partners, & Friends,

2024 was a year of transformative growth, cutting-edge innovation, and dynamic development at SERHANT. As many of you know, we raised $45M and are now venture-backed - a statement I never thought I would make as I sit down to pen my 5th (wow) annual letter. We are building a much larger and more globally impactful firm than I ever could have imagined when we began in 2020. I remember sitting down to write the first edition of this yearly update from our borrowed townhouse in Tribeca, pre-vaccine Covid, anxious about the decision I had just made to start this firm (“Who do I think I am?”, “Payroll?”, “Yes, the S stands for STRESS.”). Today, SERHANT. Technologies is redefining the sales enablement and support ecosystem through its subsidiary brands: SERHANT. Real Estate, Studios, Sellit.com, and S.MPLE. This year, we increased our YoY sales volume by over $1B (including our first-ever $1B quarter). We completed thousands of transactions across eight states and countless more through Connect, our global referral network through Sellit. We launched $4B in new developments, grew our agent count to nearly 1,000, produced 5,000 pieces of content, and grew our following by 58% across all platforms. Oh - and I released my 3rd book, Brand it Like Serhant, and our Netflix show, Owning Manhattan, premiered to rave reviews with a second season greenlit immediately.

“Change is inevitable. Growth is optional.” – John C. Maxwell

AI, BTC, AGI, VR… These acronyms are now as commonplace in real estate conversations as CRE, ROI, DTI, and LTV. As the world changes, so must we - and we must be quick. 402 million terabytes of data are created each and every day, and over half of that is video and social media usage (hello, Studios!). A ChatGPT search uses 10x the electricity of a Google search, data centers will need to quadruple by 2030, and our thirst for electricity is on pace to hit 500 terawatt-hours per year (a lot) by the same time (what happened to being green?). Our digital footprints are expanding, yet human interaction has never been more powerful as this change moves us from the tech-enabled coup d'etat of the past two decades to the AI-empowered revolution of the years to come. And SERHANT. is a first mover in that space for real estate and sales.

From launching S.MPLE on stage at Inman Connect New York (you can also watch the full presentation HERE) in January to facing the challenges of the slowest housing market in over 30 years, this has been a year of rapid change. In this letter, I share my detailed thoughts about all of the changes we’ve seen this year and those we face ahead as I discuss the state of play for the U.S. economy, the housing market, the state of technology, my future predictions, and comprehensive updates on the SERHANT. organization.

SERHANT. was built to thrive in volatile economic environments. Our wins sit on top of a foundation that supports our agents and clients by using technology and AI to create a better customer experience. We’ve proven this is the winning formula to bring new and explosive value to our industry and beyond. We’re tireless in this endeavor because we know that once we redefine our industry and achieve ‘Mission 2030,’ ‘Mission 2040’ will be hot on our heels. As we leave 2024 in the books, I am turning my focus to the coming year and everything SERHANT. has in store for 2025 and beyond. In 2023, we tested. In 2024, we incubated. In 2025, we will skyrocket in scale. I have never been more optimistic about the future as your CEO.

Feel free to jump around this letter using the navigation bar, and thank you again, from the bottom of my heart, for your time and attention. It means the world to me.

-Ryan

US Economic Update

The U.S. economy was defined by one major trend in 2024: The status of inflation. At the end of 2023, many expected that inflation would tame and the Fed would begin cutting interest rates in early 2024, but those rate cuts did not start until September due to unexpected market strength, which held inflation stubbornly above the Fed’s 2% target. The Fed made considerable progress, lowering inflation from its 40-year high of 9.1% down to 2.4% (see chart below). Now, the world watches on to determine whether the Fed waited too long or did too little to avoid tipping the U.S. into recession. At moments, that concern appeared well-founded – such as when employment numbers began to slip in early September – yet real GDP grew in each of the first three quarters and is expected to grow in Q4. This growth has been more moderate than in 2023, aiding inflation reduction. Business investment growth is down slightly from 2023 but still shows a healthy positive gain of 4.2%. Overall, the economy has shown an uncanny resilience in the face of high costs for just about everything, geopolitical conflict, and persistent economic uncertainty. We’ve seen this strength play out in the real estate markets, with nearly 70% of our firm's transactions this year being completed without financing.

Still, while household balance sheets remain strong on average, debt balances have risen (see FRED Household Debt chart below), and delinquencies have increased YoY. Similarly, while overall labor participation remains strong and wages have increased (see Statista chart below), the number of job openings has decreased, unemployment has normalized upward slightly (see FRED Unemployment Rate chart below), and various industries were impacted unevenly this year. Government spending is ever-increasing, and while it’s lower this year than last due to some belt-tightening, the national debt is exponentially higher than ever (see FRED Federal Debt chart below). It may rise even more over the next four years due to new government expenditures and tax policy. There’s a new administration in town, and President Trump’s policies could juice the economy (great!) so much that inflation resurges (yikes!), and it will take severe national budget cuts and creative revenue increases to solve that problem and gain control of the deficit.

These factors remain items of concern as the Fed determines rate policy. Fed Chair Jerome Powell has committed to avoiding speculation and making calls on rates based only on facts. Cutting rates too soon or too fast could cause a resurgence of inflation, but not cutting them soon enough risks causing a recession. All in all, most economists and financial firms place the risk of recession in the next year at only around 25%, especially with Trump in office driving market stimulation. Investors agree. The stock market is a solid indicator of investor confidence in the continued economic strength of the U.S., and stocks are enjoying a glorious bull run. Still, what goes up eventually goes down, and because of geopolitical conflicts and trade policy issues, I am betting that there will likely be a severe market downturn between now and 2030. When that time comes, remember fortunes are often made during hard times.

Investment Markets

Markets have behaved strangely this year as the U.S. economy showed persistent strength in the face of inflation and high interest rates. Conflicting data impacted various markets differently, causing uniquely modern anomalies. One example is persistently high bond yields despite the Fed cutting interest rates three months in a row[1] [2] . Now, the U.S. faces new contradictions as Trump promises to stimulate the economy but serves up policies that risk stoking inflation again. Below, I’ll discuss how different markets are reacting to this conflux of data and speculation.

Stocks

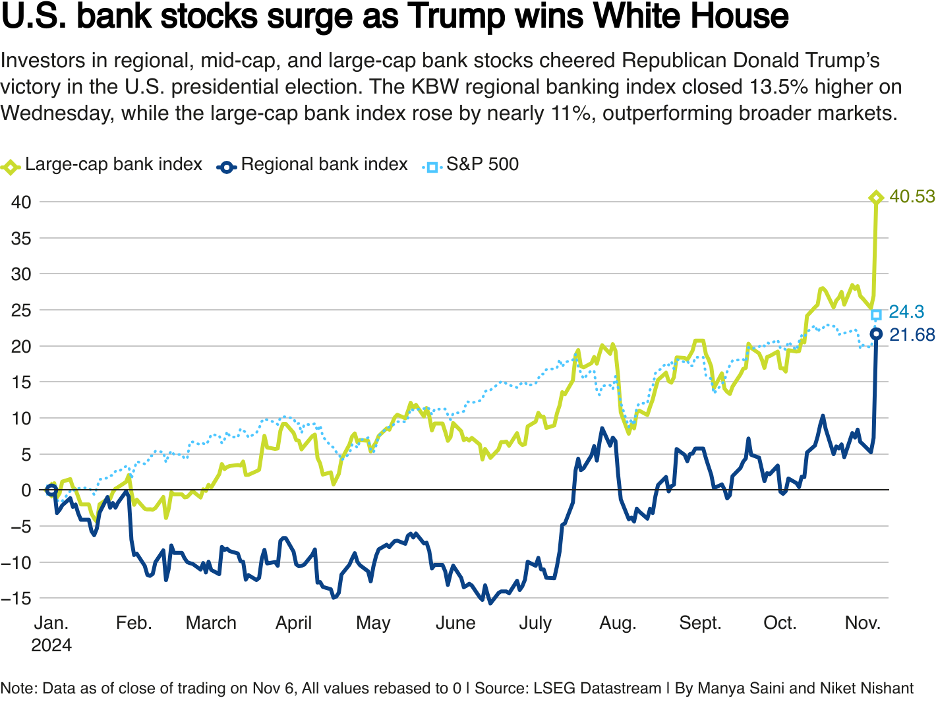

Stocks have been on a tear in 2024, repeatedly reaching record highs thanks to the thriving AI sector and tech stocks like the Magnificent 7. This culminated in the best day of the year, November 6th, after Donald Trump was elected 47th president of the United States. As of today, year-to-date, the S&P 500 is up around 28%, and the Dow Jones is up nearly 17%. With over 60% of Americans invested in stocks either directly or indirectly [Statista], this represents astronomical wealth growth amongst U.S. citizens. By many accounts, the ‘roaring 20s’ are set to continue through this decade with strong economic principles and productivity projections supporting ongoing company earnings, especially for small- and mid-cap stocks that benefit from an America-first environment.

The chart below looks at S&P 500 returns since 1950. The index has only posted a better return than what we're seeing this year seven times in that 74-year span. And returns were positive the next year in six out of those seven instances. Take a look…

Of course, the market is not without its risks. Headwinds such as rising geopolitical conflict, resurging inflation, political uncertainty, and increases in debt default could change the tides. Non-U.S. stocks, for example, are taking a turn for the worse post-election on speculation of soon-to-come rising inflation in the U.S. and globally. If that inflation comes to pass, it will also challenge domestic stock growth.

We may see some volatility in the new year as new policy initiatives are introduced, uncertainty around them is digested, and consumer spending experiences the impacts of these various policies. But, historically, we are nowhere near the height of gains or the typical length of previous bull markets. Nothing lasts forever, but I predict that any notable downturn is still years away. The wealth accumulation this bull market has catalyzed will continue to make its way into real estate and SERHANT. has been busy managing the demand.

Bonds

Bonds have been on a wild ride. After a record 793 days of yield-curve inversion, September 2024 marked the momentous occasion of the yield curve finally un-inverting. An inverted yield curve is a recession red flag, with a recession following every yield curve inversion since the 1970s [Statista], but despite the over 2-year inversion, the recession never came this time - at least not yet. The pandemic changed traditional economic wisdom, and this strange metric has abundantly clarified that.

Since the September curve normalization, the bond market saw yields on 10-year Treasury bonds spike by 21 basis points immediately following the election. They have since settled but are still higher than we saw throughout late summer and early fall. The spike was a reaction to the president-elect and his expected congress majority, causing concern for traders anticipating an increase in the deficit as taxes are cut and costly measures are tacked onto the government spending ledger. The Committee for a Responsible Federal Budget recently found that Trump’s economic policies could drive the national debt to as high as $7.5 trillion. Trump has proposed plans to combat inflation related to the national deficit, but the moves he’d like to make will be in Congress’ hands and will take time if they come to pass. This deficit risk seems to be the primary concern of bond traders, as this would cause inflationary pressure, to which the Fed would likely respond by pumping the brakes on their trajectory of rate easing or even new rate hikes. The bond market sent a message to Trump post-election to take it easy on tax cuts and expensive legislation or risk a significant rise in interest rates and hampered stock performance. Trump loves strong stock performance, so this dynamic might serve as a degree of checks and balances on some of the more costly legislation that Trump’s team has proposed.

Still, if the Fed is forced to hold rates high(er), could the yield curve invert again? If it did, would it be a harbinger of recession this time? What does this mean for mortgage rates?

I predict that today’s rate levels are here to stay through 2025, and we are working with our clients on creative options to lower their monthly payments. At many of our new developments, we are using sponsor financing and/or buy-downs to close deals.

Crypto

I’ve long shouted from the rooftops that Bitcoin was on its way to $100,000, and with roughly 140% growth since last year’s letter was published, we’re finally there! It feels so good to be right about this one, especially with one famous Million Dollar Listing New York clip from 2013 continuing to make the rounds! Even with crypto ETFs hitting the market in January, growth was steady through the winter and somewhat volatile throughout the middle of the year. But then we elected a crypto-friendly administration, and growth went through the roof, jumping nearly 30% following election day. But, we didn’t break the $100k mark until Paul Atkins was tapped as the new SEC chair on Dec. 4th. By that night, Bitcoin hit its highest price ever, just over $103,000 per coin. Even during the ‘Crypto Winter’ of 2022, I remained confident that regulation and legislation would strengthen crypto’s role in the market and help it become codified into the modern financial landscape. Paul Atkins is just the guy to lead this charge. Trump has promised to create a crypto-friendly regulatory environment, claiming the U.S. will become “the crypto capital of the planet” and that the U.S. would create a bitcoin strategic reserve to buoy national debt, and his decisions so far have lived up to the hype. The crypto markets have reacted with elation.

It’s not just Bitcoin, either. Ethereum, Dogecoin, Cronos, Neiro, and others have also seen staggering gains. Today, we’re seeing a resurgence of conversations with clients about crypto’s role in real estate transactions, and crypto ETFs are thriving.

The CoinDesk 20 captures the performance of top digital assets:

A few years ago, I said that 50% of all purchases would be in crypto. That was a bold prediction at the time, but the groundwork that’s being laid now is exactly what is needed to make that prophecy a reality. Crypto diehards: OUR TIME HAS COME!

Banking

The newly-elected Trump administration is a promising windfall for the banking industry. As Christopher Marinac, director of research at Janney Montgomery Scott, told MarketWatch, he credits “a combination of regulatory relief and prospects for more business activity (i.e., more loans and deposits), which generates greater earnings.“ He added that even small increases in deposit and loan growth would boost banks’ earnings “incrementally.” On top of this could be “modestly lower tax rates” if the Republican Party achieves majority control of the House.” This lower-regulatory environment is expected to stimulate M&A activity that has been restricted by roadblocks that will now be cleared. I expect we’ll also see the end of discussions about the Basel III Endgame Rule, which would have increased banks’ capital holdings requirement to 9%, allowing that capital to strengthen banks’ bottom lines further. The market reflected its broad support of these expected policy shifts.

Via Reuters

The banking sector is not without its challenges, regardless of the current excitement. As unexpected consequences of new policies take shape, the possibility that international relations erode due to potential trade wars, and substantial inflationary pressures loom, there is good reason for the banking industry to stay on its toes. There is also growing competition from crypto markets and the fintech industry, low loan volume due to high rates, the loans held on struggling office space vulnerable to default, and an outsized share of low-interest loans held in our higher-rate environment. As with all markets, innumerable inputs can sway sentiment and cause positive and negative impacts. The banking sector is strong, but vigilance is critical.

Real Estate Industry Update

U.S. Housing Market

Nationally, 2024 will go down as the slowest housing market in over three decades. In 2022, real estate transactions ground to a halt as mortgage rates soared and affordable housing inventory remained constricted. 2023 brought the same challenges and an even slower market. In 2024, outside of luxury sectors, the US housing market sits in a place where Americans can’t afford to sell, and most would-be buyers can’t afford to buy, slowing the gears on any momentum we expected to catch coming into this year.

The reasons for low housing inventory are numerous. Chronic underbuilding since the great recession, the explosion in private equity, a population that is living longer than ever before, the mass movement that happened in 2020-2021 due to low interest rates and remote work trends, the ‘golden-handcuff’ effect (homeowners hold low mortgage rates and are hesitant to trade them in for higher ones when they move), and rapid price increases across the nation over the last five years. Low inventory is a long-term problem without a short-term solution. Agents were bemoaning low inventory long before the pandemic sent listings plummeting. While the market has experienced some slight easing of inventory woes due to highly restricted demand as of late, the U.S. is still short as many as 7.2 million homes, causing ever-rising home prices.

While mortgage rates were below 5% for the better part of the last two decades, even reaching as low as sub-3% in 2021, demand for home purchases surged. The imbalance between supply and demand during the pandemic caused home prices to explode – prices rose nearly 50% in the last five years on average. Then, as rates ratcheted up to 7-8%, demand cooled, and for the first time in a long time, we began to see more balance between supply and demand – but all at an extremely restricted level, leaving millions of Americans out of the market altogether. Mortgage rates began to decline in August but shot back up beginning in October, reaching 7.13% post-election [mortgagenewsdaily.com]. Rates are likely to experience greater volatility moving forward as markets shift due to evolving policy, destabilizing world events, and new inflationary pressures. After years in sellers' market territory, these factors have resulted in some relief for homebuyers, with a shift to a buyers’ market environment this year. Over the last two years, we’ve seen fewer bidding wars, homes spending more time on the market, and sellers increasingly willing to negotiate buyer-friendly contract provisions.

We’ve also seen the resurgence of regionality in market conditions. For a time during the Covid market frenzy, every area across the country saw skyrocketing prices more or less simultaneously. That wasn’t normal. Now, we’re seeing markets that surged during Covid experiencing challenges and markets that stayed more steady during those years experiencing continued stable growth. This is how it should work – geography, weather patterns, demographics, employment statistics, and zoning should influence various regions differently. This return to regional price dynamics represents a normalization in the market that we haven’t seen in many years.

Domestic Migration Landscape

Via PWC

Via PWC

As we enter 2025, there are many unknowns the real estate market will face. For one, it seems climate factors have begun to make a measurable impact on Americans’ housing decisions, prompting 1 in 7 households to investigate other places to live. Beyond the weather a certain locale offers, things like aging infrastructure and power grids, the likelihood of natural disasters, and costs like insurance and utilities are factoring into more peoples’ migration choices. Zillow will even add a climate risk score to every property in its database by the end of 2024. Additionally, building starts, mortgage rates, jobs, and wages are all extremely sensitive to policy and economic performance, and with a new presidential administration in town, the market trajectory is bound to shift.

That being said, if we stay the course, the path we’re on now will lead to more balance between buyers and sellers, lower rates over time, more moderate home price growth year over year, and increased affordability for homebuyers if wages continue to grow. In fact, NAR’s housing affordability index continues to improve. While this slow stabilization is a less flashy and exciting trajectory than the pandemic market offered, this more stable outlook is what both hopeful homebuyers and homeowners who would love to move need to reach their goals. I think this somewhat “boring” balance, while not without its pain points, is ultimately great news for the near future of the U.S. real estate market – a market where there is increased inventory, improving affordability, and more reasonable levels of competition. I don’t expect 2025 to be a wildly exciting year for the national real estate market (except at SERHANT.), but as many unknowns take shape this year, I expect the groundwork to be laid for exciting times in housing to come.

For in-depth reports on our New York City and Signature markets, click here.

Luxury Markets

For several reasons, the luxury and ultra-luxury sectors of the real estate market behave differently than the more moderately-priced sector. Luxury homebuyers tend to be less rate-sensitive in their purchasing power, as nearly 45% of luxury homes are paid for all in cash. Additionally, high-net-worth individuals are benefitting from tremendous growth in personal wealth, which was realized thanks to strong stock performance this year. These homebuyers also enjoy the availability of financing options such as margin and portfolio loans and private bank loans. In fact, luxury real estate appreciated at 8.8% YoY on average across the U.S. as of the end of the second quarter. In comparison, the non-luxury market had appreciated only 3.8% YoY nationwide in that same timeframe.

The luxury market also tends to be highly location-dependent, with retiree destinations, vacation locales, and industry hubs showing greater strength on average than other markets. Realtor.com recently ranked the ten cities with the most significant price growth in their respective luxury markets, featuring places like West Palm Beach, FL, Reno, NV, East Hampton, NY, and Midland, TX. In NYC alone, we’ve seen a 9% increase in luxury ($4M+) and a 21% increase in ultra-luxury ($10M+) contracts YoY. But, even more noteworthy is the surge in luxury contracts we’re seeing at year-end – a stunning 46% increase YoY comparing September through December 12th, signaling a booming comeback after the sluggishness of 2022/2023.

While we are seeing continued strength in the luxury and ultra-luxury markets, 2024 has seen an increase in inventory and longer on-market times for these properties, reflecting an increasingly discerning buyer pool. The luxury sector does face some challenges: Strong stock market performance, such as what we see today, sometimes leads to restricted spending in areas such as real estate investment as investors resist paying capital gains to liquidate funds to allocate toward property. A strong U.S. dollar, like we’re currently experiencing post-election, can also restrict buyer activity from foreign investors, a significant buyer demographic in the luxury market.

Ultimately, homes that are impeccably presented and expertly marketed sell faster than the rest of the pack. For this reason, We provide white-glove branding packages for all our luxury listings and syndicate listings to more websites than any other brokerage, connecting with international and domestic high-net-worth portals in 80 countries. For luxury properties, SERHANT. Signature provides tailored, elevated service designed to showcase fine homes like no other real estate firm can.

Commission Lawsuit Outcome

The real estate industry experienced a shake-up this year as new rules regarding the handling of real estate agent commissions swept the nation. As a result of a lawsuit filed by former home sellers against NAR (The National Association of REALTORS), which NAR agreed to settle, the industry has reshaped how commissions are negotiated and handled between real estate brokers and their clients.

In the past, when a homeowner decided to list their home for sale, they would negotiate the entire commission rate with the agent listing their home. That listing agent would then offer a commission split that they would share with the agent who brought the buyer to the table and facilitated the buyer’s end of the transaction. In other words, the seller paid the listing agent a commission, and the listing agent paid the buyer’s agent part of that commission. The NAR lawsuit deemed that practice unlawful. Now, the seller and their listing agent negotiate the commission paid to the listing agent, and the buyer and buyer’s agent have the option to negotiate the commission paid to the buyer’s agent separately. This change effectively means that a homebuyer is ultimately responsible for paying their agent out-of-pocket if necessary, potentially adding a substantial cost burden to homebuyers when housing affordability is already strained. Because of these affordability challenges, what happens most often is that homebuyers request in their offers on a home that the seller offer a credit at closing to cover their buyer’s agent’s commission, effectively rolling the commission into the purchase price of the house – which, by the way, is just a reengineering of how we’d always done it before.

So far, there has been little change or impact on the real estate market due to these new laws. In fact, in luxury markets, I’d argue that commissions have actually increased. It’s a hard metric to track, as commissions are not always public knowledge, but at SERHANT. we’ve seen increasing commissions to create competition for properties priced north of $10M. There is no reason to believe that market activity or buyer demand has decreased since these changes were enacted this past summer. As the market shifts, however, such as when more inventory hits the market, or we re-enter a scorching hot sellers' market, we will likely see a change in how buyers and sellers use commissions as a negotiation tactic. We could see buyers choosing to forgo using buyers’ agent services to save money, or they could use it to negotiate a better price. While there may be limited cases in which that would be a prudent strategy, it would expose the buyer to serious legal and financial risks and likely result in the listing agent receiving an increased commission that could compromise the buyer’s perceived savings without transparency. Seeing how these new laws play out in different market conditions will be interesting and may set new precedents over time.

The most significant changes we’re seeing thus far are in the paperwork and negotiation strategies the parties to a transaction must engage with. I spoke with CNBC when the lawsuit settlement was announced and went on the record to say that anything that increased transparency to the parties of a transaction – which these changes were intended to do – was a net win for the industry, a sentiment that I stand behind fervently. Unfortunately, I believe that the way the industry implemented these changes has resulted in greater complexity and more opacity to the detriment of the consumer. The contracts are more confusing, and the negotiations are more circuitous. We see that the best properties have never even been brought to the open market now, as the seller often has more to gain by selling off-market. These impacts contradict the lawsuit's intent and our desired outcome as industry insiders. Now, the Department of Justice (DOJ) is coming out against specific provisions of the settlement, saying they may stifle competition – to what effect is yet to be seen.

The lawsuits are not over yet. The next big lawsuit the real estate industry faces in 2025 addresses clear cooperation. This practice requires REALTORS to enter any home they list in the MLS (multiple listing service) database. The lawsuit alleges an antitrust violation and argues that home sellers should have a choice as to how they market their homes. REALTORS argue that it is in the seller's best interest to have their home exposed to the most buyers possible and that the MLS and syndication services that pull their data from the MLS are the best way to accomplish this. Besides, contracts already allow sellers to exclude their homes from the MLS, and provisions exist that allow for ‘pocket listings.’ Like the commission lawsuit, I expect this will lead to diminished consumer clarity while exposing brokerages to greater liability and fewer protections for essential provisions such as commission and time-on-market opacity. The question that we, as real estate professionals, must ask ourselves is what should we do when the associations that govern us, associations of which we are paid members, expose us to greater liability and prevent us from representing our clients in the most ethical manner possible? At SERHANT., we consider ourselves incorruptible and will defend our agents and clients against anything that diminishes clarity or increases their expenses with the highest regard for dignity in business dealings.

President Trump 2.0—

Analysis of Potential Real Estate Impacts

In November, the U.S. elected President Trump to serve his second (non-consecutive) term in the White House as the 47th President of the United States. Voters widely ranked the economy and high housing costs as top priorities in their voting decisions. While Mr. Trump and his team have yet to put forth detailed plans regarding their economic policies, much of his campaign was centered on these issues. Of course, campaign talking points aren’t always implemented as promised and can change dramatically once a President takes office and installs new people in positions of power. However, we can use these talking points to gain insight into how the Trump Administration thinks about the economy and housing market and the pathways they are exploring to address perceived problems.

I’ve identified the top six promises Trump made on the campaign trail that, if enacted, will likely impact real estate positively or negatively.

1. Tax Policy

Thanks to the Tax laws he signed into law in 2017, we already have quite a lot of insight into Trumpian tax policy, from reduced corporate taxes to caps on state and local taxes (SALT), removal of deduction caps, and advocacy for programs like 1031 exchanges and opportunity zones. We expect the incoming administration to extend and reenact these programs. While Trump’s ideas on tax policy vary in their impact by region, socioeconomic status, and more, the luxury and ultra-luxury real estate sectors benefit from many advantages under his tax code. The issue that Trump will face with implementing new tax cuts (beyond renewing the 2017 measures) is how they would impact the ballooning national debt. Without policies that would create new revenue (of which tariffs, as well as crypto investments, are two possibilities) and drastically cut spending (such as eliminating entitlements), new tax cuts may not be enacted as they could cause inflation and increased interest rates and could cause stock prices to lag – all of which would be hard on the economy and public perception of the administration if they came to pass.

2. Reduced Building Regulations

Eliminating red tape that increases the difficulty and cost of building new homes is a much-welcomed policy for most Americans and real estate industry professionals. The cost of a new home is estimated to have increased by $90,000 on average due to regulation expenses. While that number falls short of the 50% Trump posited that could be saved on the cost of a new home once building restrictions were eliminated, the savings would be monumental and allow for an increase in much-needed construction of residential properties across the U.S. The administration may see snags in this plan as many regulations they’d seek to relieve are in the jurisdiction of state and local governments. Still, red states and counties, in particular, stand to benefit from this plan. Democratic lawmakers have also supported decreased regulation for homebuilding as of late, so these measures have a good chance of passing.

3. Building on Federal Land

Another well-regarded policy amongst most Americans and real estate insiders is the plan to open up certain areas of federal land to construct new homes. I commented on this while in Dubai a few months ago, and you can read my thoughts in Arabian Business. These lands could see fewer building regulations, lower construction costs, and low property taxes. One downside of this plan is that there is little federal land available where most people work and live. Still, programs are being piloted that would allow for several federal agencies, including USPS and USDOT, to free up land for building in areas with housing shortages, and it is estimated that 1.9 million units near transit (though not necessarily populated areas) could be built nationwide. 1.9 million units would make a sizable dent in the U.S. housing shortage and be considered an indisputable win if it comes to fruition.

4. Deportation Efforts

Trump has pledged to implement “the largest deportation operation in American history,” arguing that, in part, this will ease demand for homes and rentals, thus bringing prices down. While there may be some truth to the concept that large immigrant populations in certain areas play a role in marginally increased demand for housing and slightly higher prices, the expected impact on housing prices due to this policy is minimal, in my opinion. Furthermore, this plan has short- and long-term risks that could drastically impact the real estate market.

For one, nearly 30% of the residential construction workforce is comprised of foreign-born workers (National Association of Home Builders), and many construction jobs already go unfilled. If the unemployment level were very high, this might not pose an issue as there would be plenty of U.S. citizens ready to step into the vacant positions; however, with unemployment at only 4% and a sustainably strong job market, no such pool of potential replacements for construction job vacancies exist. Deporting these workers could result in a massive slowdown of already minimal residential construction and increased construction costs, which would be passed onto the consumer.

Secondly, the cost of deportation of some 13 million immigrants would be deeply logistically complicated, unfathomably expensive, and would balloon the already astronomical national debt. As I previously mentioned, an increase in national debt would be a substantial inflationary pressure, and with inflation comes even higher mortgage rates – an obvious net negative for the real estate market.

Finally, the U.S. has a birth rate problem, with the current birth rate of 1.7 children per childbearing person sitting well below the rate of 2.1, which would be necessary to sustain the population. Immigration has offered the solution to this problem, as without immigration, the population would shrink. A declining population has many far-reaching catastrophic consequences and would reduce real estate demand such that house prices would plummet. One need look no further than China’s housing market problems for evidence of the havoc a declining population can wreak. If pathways for increased legal immigration are introduced and made accessible to those who wish to immigrate to the U.S., and policies emerge that support a higher birth rate, the fallout of tighter illegal immigration policies could be mitigated, but to what extent remains an important question.

Via cbo.gov

For these reasons, it seems unlikely that mass deportation will occur as the risk of economic harm seems much more significant than any potential benefit. Instead, we can bet on stricter policies on illegal immigration, which would not have such a devastating impact on real estate.

5. Tariffs on Imported Goods

One of Trump’s more hotly contested policy proposals concerns imposing 60-100% tariffs on imports from China, 25-100% tariffs on imports from Mexico, and up to 20% tariffs on all other imports. The idea is to implement tariffs to decrease U.S. reliance on imported goods in favor of goods made in the U.S.A. In combination with other fiscal policy measures that increase revenue and lower costs, tariffs could help reduce the federal deficit; however, as a standalone policy, tariffs would be inflationary by increasing consumer costs. Inflation pressures could be reduced as the tariffs bring in revenue to offset the national debt. Still, they would need to be combined with other measures that could be divisive and would require Congress' approval to impact the economy for the better meaningfully.

The potential problems that the real estate market could suffer if these tariffs are imposed include increased construction costs of homes due to increased prices of imported construction materials and the possibility of higher mortgage rates if they prove to be inflationary.

6. Mortgage Rates

Trump has often promised that when he takes office, he will bring mortgage rates down to 2-3%, but it’s hard to imagine how he’d accomplish that, as the president has minimal control or impact on mortgage rates. Even the Fed, an independent nonpolitical federal agency that Trump has insisted he wants more control over, does not actually determine mortgage rates. Mortgage rates are determined by economic data and investors’ reactions to that data, and they closely follow 10-year Treasury bond yield trends. Investors are currently presuming that some of Trump’s policies will stoke inflation and increase the national deficit, sending T-bill yields higher despite the Fed’s recent interest rate cuts. This has sent mortgage rates higher in the wake of the election. As the new administration takes office, investor fears may be quelled, and rates could resume their decline. Regardless of the short-term impacts, volatility is expected during this presidential term as all three branches of the government have a conservative majority, allowing for changes to occur more rapidly than in previous years when there was more gridlock. After all, markets love gridlock as it offers assurance and slow change.

Despite these talking points, data supports that regardless of the outcome of a presidential election, the housing market typically sees a boost in the year following the election. In fact, in 9 out of the last 11 elections, home sales increased the year after the election, and in seven of the previous eight elections, home prices went up the following year. This could be attributed to slowdowns in the real estate market driven by consumer uncertainty in the months leading up to a major election, a new president’s determination to have a positive impact on their constituents' lives and the policy that supports that, or other random unrelated data – but the numbers don’t lie. For this reason and many others, I have faith that the 2025 housing market will show improvement over the 2023 and 2024 markets as we clear the way for a new administration, shake off the stagnant energy of the last few years, and pump the market with some fresh juice to fuel its next moves.

Automation Revolution

The adoption of automation and AI has exploded in 2024, with 72% of organizations now using AI in at least one business function, up from 50% last year. However, only 8% of organizations use AI in at least five business functions [McKinsey]. SERHANT. has embraced AI in every department, and I strongly believe that most organizations are getting it all wrong. Streamlining departments and increasing profit margins by reducing staff are features that AI offers, but the downside of companies that utilize this approach is that they become more robotic. They are drastically underutilizing and misunderstanding the breadth of the capability of these technologies’ ability to shift our peoples’ critical functions away from desks, behind screens, and back into the real world to create more human businesses, the way people have been craving since the beginning of the technological revolution.

In my letter three years ago, I talked about my excitement for emerging technologies like the blockchain to modernize and secure the real estate industry. While that hasn’t happened yet, real estate is about to see an explosion in use cases of AI and blockchain frameworks as the incoming administration has declared extreme friendliness to crypto, as discussed earlier in this letter. There are now plans to put forth the first government regulation of any kind that will pave the way for more mainstream usefulness, adoption, and creative application not only of cryptocurrencies such as Bitcoin and Ethereum but of blockchain-based technologies writ large. It was always true that it was not possible to proceed with blockchain tech in this space until, as a society, we had the benefit of more time to analyze the space and until regulators began introducing and passing legislation on the topic that put a framework in place in which commerce could operate. That will likely happen now, which has made my prediction more possible, even if it hasn't come true yet. The AI revolution has caused a mega boom in the connected technologies space, specifically regarding LLM and LAM-connected platforms intertwined via APIs, that will intensify as agentic AI frameworks continue to gain momentum. We're seeing transaction management tools and companies begin to shift to a microservices architecture that allows for anything that can be done with a mouse and keyboard to be done via API by a bot or instruction set that can be passed through, or both. This fundamental change within the transaction management space lays the groundwork for more straightforward integration with blockchain-based conveniences and protections.

Leveraging emergent technologies has been central to SERHANT.’s mission since our inception, but in 2024, we took our biggest leap forward yet, launching an AI-backed tool that has changed how we work and given us more time to live. Because SERHANT. has a first-mover advantage in the automation space; we’ve had the opportunity to experiment, fail, and learn from those failures as we introduced AI-leveraged tools to our people while everyone else was still trying to figure out what AI is. The problem we came up against over and over was adoption. No one wanted to have to master being an AI operator. No one wanted yet another program, yet another screen they had to learn to use and incorporate into their daily lives. People are not longing for more tech to incorporate into their lives but rather for their lives to become easier, more connected, and more HUMAN. Herein lies the problem that every organization in the world will face as they incorporate AI and automation into their practices.

We’ve long believed that we must build our tech to allow anyone to work from anywhere on any device. That philosophy has evolved to include the idea that we must also reduce screen time and the number of platforms our people need to interact with throughout their day and empower them to spend their time in the real, physical world with other people. You can see that thought evolution taking place in my prior letters:

In my first company letter in 2020, I wrote: “You may think you know what we are doing to disrupt the marketplace, but you have no idea!”

In 2021, I warned: “We are most threatened by the things we don’t yet appreciate and understand… Sometimes, the cost of our inability or unwillingness to pivot causes a business or sector irreparable harm.”

In 2022, I committed: “Technology will increase our brand continuity and help integrate our products and services with our clients’ lifestyles. For 2023 and onwards, the most important agenda item will be the development and integration of high-quality technological infrastructure.”

Then, in 2023, I teased: “We stand on the brink of a historic technological revolution, and I fearlessly commit to leveraging available resources in the present while keeping a keen eye on the boundless potential of the future. While everyone else is asking the question, “How can AI make the agent better,” SERHANT. is asking, “How can we use AI to build a better brokerage?”

This year, we launched the culmination of our work in this space: S.MPLE. S.MPLE is the best Large Action Model to have ever existed (in my humble opinion) and the first one to ever hit the real estate industry. S.MPLE combines SaaS and human expertise to create what can be imagined as a digital factory assembly line that can take over the administrative tasks of salespeople and teams—ranging from marketing to client follow-ups and transaction coordination. Simply put, S.MPLE frees agents to focus on selling. Since launching, S.MPLE has processed close to 2,500 requests, saving agents more than 5,000+ hours by allowing them to manage their entire operations using only their voice–and that was just while we were in beta testing. Today, S.MPLE can perform 20 complex tasks or ‘Recipes’ that used to take agents hours in a matter of moments. And with every input, S.MPLE gets stronger, smarter, faster, more customized, and more capable of performing innumerable tasks. Selling and buying real estate just became a whole lot more S.MPLE, only at SERHANT.

I started SERHANT. because there was no other brokerage that was offering what I needed. I didn’t need a brokerage that promised to make me better – I was at the top of my game. I needed a brokerage committed to being better itself, a brokerage that focused on service to me as an agent and empowering me to care for my clients at the highest level possible. I needed a brokerage that had its eyes fixed on the future and was willing and able to use every tool at its disposal to empower me and create a better experience of work and life. That brokerage didn’t exist, so I built it.

From the very start, we talked about how to take the most cutting-edge technological advancements society had to offer and use them to build the most HUMAN brokerage the world would ever see. As a result, while the rest of the industry is pushing chatbots to nurture leads and GPTs that write stiff copy for agents’ marketing, we’re offering an app that does the work for our agents in a fraction of the time using an interface that is entirely intuitive and streamlined… And that’s just one example of how automation makes SERHANT. better. Every department in our multiple organizations uses automation – from cyber-security to financial applications to generative output and task management – to scale, simplify, and create hyper-personalized real human support. Because of our first-to-market innovation in the AI and automation space, old-guard real estate companies will struggle to compete, and I predict many will go the way of blacksmiths, Blockbuster, and Borders Bookstores. Shots fired! Game ON!

SERHANT. Business Update

By all qualitative and quantitative measures, 2024 was SERHANT.’s best year ever. This year, we increased our transaction volume by 75%, transaction count by 90%, and our inbound referrals by 131% YoY. We increased our sales volume by over $1B YoY despite 2024 seeing fewer home sales nationally than in 2023, making it the slowest year for real estate in over three decades. Further, at SERHANT. we increased our market share by nearly 90% vs. 2023 and continued expanding, adding new agents and teams in new markets throughout the country - from the Hudson Valley and Charleston to Atlanta, we doubled our agent headcount yet again this year, which we’ve done every year since we started in 2020. We’ve nearly crossed the threshold of 1,000 incredible SERHANT. agents. This year has marked a landmark set of achievements as we set out to prove we had the winning strategy, a goal we’ve now soundly conquered. The stage is set for massive growth and even greater innovation in 2025.

In preparation for that growth, much of our focus this year was on our unwavering commitment to tech and innovation as we tested and incubated our offerings to perfection. To that end, we launched the industry’s most innovative proprietary AI platform, S.MPLE (that I went into in-depth earlier in this letter). We firmly believe that the power of AI will allow us to be more personable as real estate agents, and we are creating the industry’s first and only tools that allow you the time to do so. It’s fitting that we launched the disruptive force that is S.MPLE this year, as 2024 was the 30th anniversary of Amazon’s creation and the 20th anniversary of Facebook’s launch – two of the most disruptive inventions to their respective industries ever. S.MPLE is now available exclusively to SERHANT. agents in every market we serve.

On top of all this, we’ve continued breaking records with new listings and new developments that captured public attention, like the launch of Mercedes Benz Places in Miami, which has sold at a record pace, unlike anything we’ve ever been a part of. We’ve done multi-million dollar deals, listed some of the world’s most unique and coveted homes, and celebrated our incredible team members who helped us get to this unbelievable place. Thanks to our powerful PR team, we secured over 1,100 media placements and reached a staggering 25 billion media impressions globally (an impressive 56% increase year-over-year). We secured our place yet again as the #6 best-selling residential brokerage in New York City, beating other companies in the top 10 that have been around for decades and whose agent counts eclipse our own. How do we do it? By being unwavering in our vision, uncompromising in our values, and deliberate in taking strategic steps to crush our goals every single day. Read on below to learn how every department at SERHANT. has thrived and innovated this year in our quest to become the #1 firm in the United States by sales volume

Signature

SERHANT. Signature, our HNW listing and buyer platform, had a breakout year as we scaled the offering into our new markets. The results speak for themselves: Signature branded properties sold at an 18% premium (up from 16% in 2023). The Signature offering for sellers works because it’s the most comprehensive marketing package in the industry, with a distribution funnel that no other firm can come close to. From incredible social media exposure to personal websites and exposure to private rolodexes, Signature has become the go-to for luxury listings in our markets. For buyers, our Signature agents have access to more off-market homes than any other brokerage, helping our clients secure generational trophy homes. Some of our incredible Signature sales this year include full floors at 520 Park Avenue and 200 Amsterdam, Hamptons estates, Delray mansions like 3 Ocean Lane and 1964 Royal Palm Way, and more, up and down the East Coast.

We also expanded our Signature offering to Commercial this year, listing amazing properties like 548 West 22nd, 281 Park Avenue South, and more.

New Development

Our new development team knocked it out of the park this year with $4B in inventory and nearly 50 projects in total for 2024, and even won the “Best Sales and Marketing Campaign for New Development 2024” by Inman’s Golden Club for Mercedes-Benz Places in Miami. Our New Dev team has been relentless in their efforts to scale and innovate, which has attracted unparalleled attention and record-breaking deals for our developer clients.

Among our 2024 wins are the following:

One Williamsburg Wharf

Within the first month, we achieved an impressive milestone: 30% of units were sold

Mercedes-Benz Places in Miami

Awarded nationally as the “Best sales and Marketing Campaign for New Development 2024” by Inman’s Golden Club

Sold 100 units in under 5 days

200 Amsterdam

Since taking over the project, we have increased traffic by over 150%

Over $18M in contract in November of 2024—blending at $3,460psf.

Mason LIC

60% sold in just 3 months on the market

Huron

Top 5 PPSF signed contracts in Greenpoint YTD

Top 4 PPSF in Greenpoint all-time

#1 sponsor PPSF in ALL of Brooklyn!

Top 3 sponsor sale prices in Greenpoint YTP

Quay

Over $180M sold in less than one year and broken multiple records

Currently over 90% sold

Brooklyn Point

Since we started marketing the project, we sold over $400M in inventory

This year we are currently 90% sold

WYND Miami

Leased up within 5 months from relaunching with SERHANT. New Development

475 Kent

PH1 broke the record for the most expensive rental new development in South Williamsburg

The Laney

Leased over 35% of the building within the first 6 weeks and were able to pull away from concessions and promotions

People

Our new agent acquisition proved immutable in 2024 as we doubled our agent count to almost 1,000 total agents across all our markets. The LTM sales volume of our new hires alone was an astounding $2.6 billion, representing immense value added to SERHANT. Our recruiting efforts are underscored by our press and media brand recognition and our incomparable offerings. Our existing agents and new hires alike enjoy what we refer to as ‘The SERHANT. Effect,’ often doing the largest deals of their careers once they make the move to join us and then posting about it on their social media accounts, creating new organic recruiting content.

The secret to the synergy between SERHANT. and those who join us is we target people who match our vision, are mission-driven, have a growth mindset, are entrepreneurial, and are deeply invested in the concept of brokerage 3.0, understanding that what we are building has never existed before, and we’re all building it together. We listen to everyone in our organization to understand what they need to work and live better, and then we build it. It’s this that makes us the most empathetic, human brokerage ever, in my opinion.

Tech Department/ADX Team/Cyber Infrastructure

Tech innovation is baked into the heart of everything SERHANT. represents, and we’ve differentiated ourselves in the marketplace in this regard in 2024 like never before. Some of the tech tools we’ve built in the past suffered from low adoption rates because, as we learned, our agents did not want to master and engage with yet another platform, no matter how impactful I personally thought the platform was. When we asked the question, not only what can AI do and how do we leverage it, but how do we bring that paradigm shift to our agents without forcing them to become operators, that’s when the magic happened.

2024 Tech Team Accomplishments:

SERHANT. GPT: Our industry-first listing data-connected AI tool that helped our agents get maximum value from AI was a smash hit. No longer a standalone tool, we successfully rolled it into S.MPLE to power the magic that our agents experience daily. S.GPT serves as a key example of how innovating home-grown tools that align with our vision and our agents' needs so well can be precursors to mega-hit services that change the industry the way S.MPLE is doing.

Expanded and enriched SLAPI, the SERHANT. Listings API, with more market data and other data types than ever, and successfully rely on it every moment of every day to power our vital tools, especially S.MPLE. SLAPI now contains data on nearly three dozen markets.

Launched S.ENTRAL, our mega database that contains all pertinent company data ranging from business intelligence to personalization data on our customers and their VIP clients to power company initiatives and goals as well as our services and tools daily.

Launched an API for our S.RM: The SERHANT. Relationship Manager, which is better connected to our other tools than ever before, especially S.MPLE, allowing agents to spend as little time in their CRM as possible.

Our new website, launched in January 2024, appeared in web searches nearly 10M times, attracted nearly 3M unique visitors, generated more than 12M page views, and tens of thousands of listing inquiries.

Continued to be regarded as the industry-leading tech-forward go-to thought partner for the brightest and best of the entire tech landscape to represent the residential real estate industry in private discussions on what we're doing and what we think of others' work in the AI space.

Secured a partnership with Palazzo AI, Co-Founded by Tennis legend Venus Williams, to bring industry-leading AI virtual staging to our agents and deliver it to them via S.MPLE instead of being held captive by the tradition of just making another tool available that agents would have to learn or waste time operating themselves.

Garnered praise and generated curiosity from leading AI and ML experts and companies on our pioneering methodologies regarding the combination of psychological data and generative AI, as well as workflow automation for salespeople, cementing us as a thought and execution leader on unique practical applications of AI tech.

We know better than anyone what agents need to go further without doing more because our CTO and tech team have an unwavering focus on radical hospitality. Because of that, they innovate scalable solutions using mindful technologies. We’ve learned that psychological insights must drive tech investments, and when they do, it results in unimaginable growth. We’ve folded all these lessons into our present systems and built them to allow AI to do the work for our agents and staff. At our tech department’s core, we are using AI and automation in ways most brokerages can’t dream of to tailor communication, anticipate needs, and surprise and delight our agents and their clients.

ID Lab

ID Lab, SERHANT.’s in-house creative production studio, grew our offerings in 2024 and, in turn, supported the company's growth as a whole. To drive this growth, we’ve expanded our team, including hiring our Design & Marketing Associate Director, who has extensive experience in the luxury real estate space supporting elite agents & teams, making her the perfect person to offer the very best the industry has to offer to our power brokers and teams. We’ve also begun expanding our in-person presence to all our markets, starting in Miami and preparing to scale with the brokerage to new markets in 2025, all while working to reduce service costs.

This year, ID Lab began a push to offer our premier branding package to all SERHANT. agents, unlike other brokerages who reserve similar services only for their top producers. Our premier branding package leverages what makes our agents unique to generate creative solutions so their brands stand out amongst the pack.

We’ve found that these bold ideas and disruptive amplification drive real results. Our Signature branded listings have sold faster and for more money than their competitors since June of 2021, based on data pulled from our Head of Research, Courey Napier. Because of this, we’re looking to make Signature more accessible to all markets in 2025.

Thanks to our combined efforts, we’ve designed brands for 48 agents and 20 premier agents this year and produced stunning branding packages for 60 signature properties and 16 new development projects. ID Lab is the tangible manifestation of SERHANT.’s belief that strong brands win in today’s marketplace, and the brokerage of the future helps its agents do just that. As such, ID Lab offers a fortune-500 level ad agency experience, agent-first service, and white glove treatment to each of our agents and projects to propel them further and higher than ever before.

Social Responsibility

One of our company values at SERHANT. is to create for tomorrow. We don't just work in our communities; we live in them and are committed to engaging deeply to serve as a positive example to build their futures. SERHANT. agents continue to be role models in their communities and positively impact their markets through charitable efforts with organizations that they are deeply and authentically connected with, including the following and many more:

New York City

Rescue City: Rescue City is a professional, foster-based dog rescue based in Brooklyn, New York. They conduct lifesaving rescue transports from open intake shelters that are unable to save a high percentage of animals. Thanks to their efforts, hundreds of dogs are saved every year.

NYC New Development

Mamma's Give Back: NYC Mammas Give Back is a 501 (c)3 non-profit organization that provides pregnancy, postpartum, infant, and early childhood essentials and support to agencies and shelters in the NYC area serving pregnant women, families, and children (ages 0–5) experiencing homelessness and poverty.

Long Island

Tri CYA (Tri Community and Youth Agency): The Tri Community and Youth Agency (Tri CYA) is a private, not-for-profit, community-based agency dedicated to supporting the growth and development of youth and their families in the communities of Huntington, South Huntington, and Cold Spring Harbor.

New Jersey

The Warehouse NJ: The Warehouse NJ helps individuals and families who have experienced homelessness successfully transition into their new apartments with donated furniture, household items, and other essential needs. SERHANT. team, New Jersey Real Estate Group, including Amy Lutz, is involved in this charity, which helps people experiencing homelessness. Amy, who is also a designer, donates furniture to help furnish homes when these individuals secure housing.

Pennsylvania

Ronald McDonald House: Ronald McDonald House Charities® (RMHC) of the Philadelphia Region supports families on their children’s medical journeys with a community of comfort and hope. They envision a world where every family can focus on their child’s well-being.

South Carolina

EMPOWER: SERHANT. agent Justin Cheesman's organization, EMPOWER, has partnered this year and this holiday season to help coordinate the construction of a women's shelter in Greater Hilton Head, Town of Hardeeville, SC. Justin himself is not only raising money but also assembling all of the trades, from electricians and plumbers to general contractors, to build the shelter. In addition, Empower is continually raising funds on its website, which is linked above.

Tunnel to Towers: Tunnel to Towers is able to continue our mission to “do good” by providing mortgage-free homes to Gold Star and fallen first responder families with young children and by building specially adapted smart homes for catastrophically injured veterans and first responders. Tunnel to Towers is also committed to eradicating veteran homelessness and helping America to Never Forget September 11, 2001.

Georgia

The Humane Society of Greater Savannah: Rhonda Pulte, SERHANT. agent, has worked for the Humane Society of Greater Savannah for seven years. She donates her time to fundraising and adoption events, fostering and training, and walks the dogs at the shelter once a week. This year alone, she has donated over 500 volunteer hours. She also donates financially every Christmas.

Downtown Neighborhood Association Holiday Tour of Homes in Savannah, GA: Rhonda is also the Co-Chair for the Downtown Neighborhood Association Holiday Tour of Homes in Savannah, GA. The organization raises money and gives grants to local non-profits. Last year, it donated $50K to 22 local non-profit organizations in Savannah, and this year, it is on track to donate even more. Rhonda’s commitment to The Downtown Neighborhood Association earned her the Volunteer of the Year award for 2024.

Florida

Branches FL "Under the Tree Toy Shops" Toy Drive: Each December, Branches FL transforms its three locations into holiday wonderlands where parents can select new toys for their children. As they shop, parents enjoy festive music and treats, and each gift is beautifully wrapped by Branches volunteers and staff.

Second Harvest Food Bank: Second Harvest Food Bank of Central Florida is a private, nonprofit organization that collects, stores, and distributes donated food to more than 750 feeding partners in seven Central Florida counties. Last year, with the help of numerous donors, volunteers, and a caring, committed community, the food bank distributed enough food for 76 million meals to partner programs such as food pantries, soup kitchens, women’s shelters, senior centers, daycare centers, and Kids Cafes.

Impact of Netflix

This year, SERHANT. was proud to announce our partnership with Netflix in premiering Owning Manhattan to living rooms across the world, landing in the top 10 in 40 countries globally, and dubbed “real estate reality at its finest” by TIME; we were covered everywhere from the LA Times to The New York Post and even landed ourselves in Vogue! Owning Manhattan reflects what it's really like to work in this business, the ins and outs, the highs and lows, and, of course, some of the world’s most glamorous real estate. We celebrated with an epic premiere party in New York City with 800 real estate agents, clients, and friends.

With this launch, we leveraged reality TV as a strategic pillar of growth and differentiation for the entire SERHANT. brand. Owning Manhattan builds upon our existing content-to-community-to-commerce flywheel approach by expanding the reach of our brand to over 190 countries and over 280 million subscribers. Immediately when the show dropped, we saw a 10x increase in inquiries from prospective agents wanting to join SERHANT. We have seen an increase in brand awareness and recognition, surpassing 8 million organic followers on social media, all of which have amplified our ability to drive new markets and support our agents nationally with lead inquiries. In our first 30 days on the air:

Social Reach

SERHANT.’s social media reach increased by 88% across platforms

SERHANT.'s content impressions increased by 181% across platforms

SERHANT.'s social engagements increased by 71% across platforms

Business Results

SERHANT. saw a 285% increase in listing inquiries

SERHANT. saw a 1915% increase in traffic to SERHANT.com

SERHANT. saw a 400% in inbound agent leads

This strategic partnership has impacted the lives of not only the cast members but also SERHANT. agents uninvolved with the show directly, simply by association. As an example, one agent not on the show received a lead and closed on a $15 million property in Tribeca. Another agent, who is a single mom, happened to be in our Hamptons office when someone who’d seen the show walked in with an inquiry. She closed a career-altering $8 million sale with him.

In a world where attention is the most important commodity, a content-as-top-of-funnel approach is well-proven, and what better reach could you hope to get with your content than Netflix can offer? Reality TV is not without its critics, nor am I, as I’ve built my career in the spotlight. Innovation will always be critiqued by those who don’t understand or can’t follow suit. The show has catapulted our brand onto more than 280 million TV screens around the world, and we can’t wait to show you Season 2.

Studios

STUDIOS is celebrating another banner year as SERHANT.’s award-winning in-house film production company. This year, we successfully piloted a launch and expanded our STUDIOS offerings in three new markets — Orlando, Long Island, and New Jersey. We proudly accepted our third Shorty Award for their Through The Lens Of series, which brings to life our agents' unique personalities and the magic of their valued listings, honoring the cinematic tradition of video and filmmaking by producing stunning short films in the style of iconic filmmakers. We produced campaigns to promote our Netflix premiere of Owning Manhattan and my newest book, Brand it Like Serhant. We also created campaigns for Adobe, Sony, BMW, Meta & Chase. Mercedes Benz and JDS hired us to show the world how they’re reimagining new development in Miami, and Netflix hired us to capture property footage for Owning Manhattan. In total, we produced over 500 property tours, marketed 35 new development buildings, and produced 51 signature property tours.

Now, our award-winning content division is looking forward to being available in all of our markets via Studios Suite in 2025 so that we can transform the media presence, expand the reach, and resonate more deeply with the audiences of all of our agents nationwide.

Sell It

This year, our EdTech division, formerly known as VENTURES, rebranded as its own standalone company, Sellit.com. Answering a call that thousands of our members have issued, we began offering 1-on-1 pro coaching in addition to our existing signature courses.

Since January 1st of this year, we’ve signed on 15,213 new members, bringing our total membership to nearly 37,000 across 128 countries. In 2024, we serviced two marquee clients: JPMC and IBM. For them, we offer a multi-week training for their sales teams using our proprietary sales approach. Finally, we hosted the one-day-only NYC-based Sell It Mastermind for a select group of 250 attendees and did more deals than we did last year from our two-day Miami-based mastermind with twice as many attendees, reflecting the increased interest and resonance our new offerings have with our audience.

The one-on-one coaching program evolved from our former brand-focused offerings to a powerhouse offering in operations, sales, and systems, delivering top-notch real estate coaching through new curriculum and program development. We restructured our support team to elevate the client experience and launched a high-impact communication plan to announce our enhanced program to the world! In a fantastic recruiting push, we brought on 12 real estate coaches, revamped the onboarding process, and appointed a head coach to build a solid, engaged coaching community. We also set up a coach recruitment pipeline to keep talent flowing seamlessly from interest to onboarding. With essential content guides, weekly meetings, and a real-time directory, our coaches are more connected and aligned than ever with our agent community!

SERHANT. Conclusion

As we close the books on 2024, I couldn’t be more proud of all we’ve accomplished. This year has highlighted our resilience, innovation, and the unwavering spirit of our SERHANT. community. As the new year approaches, I’m filled with an electric excitement for all 2025 holds. We’ve laid the groundwork for explosive growth, and now it’s time for us to ignite the fuse. Get ready as we blast across the U.S., bringing our groundbreaking strategies and radical humanity to every new market we touch.

Next year is not just another chapter; it’s the beginning of a thrilling new era for SERHANT. as a technology company, and more than just a real estate brokerage, media company, or ed-tech empire. After all, as the great Alan Kay once said:

"The best way to predict the future is to invent it."

We will remain unwaveringly committed to being our space's most innovative and human-centered organization. We are revolutionizing what it means to work, using technology to shift our focus away from screens and back towards relationships to build deep communities, craft unforgettable experiences, and create richer lifestyles. The opportunities are limitless, and we want you right there with us, pushing boundaries and shattering expectations. Let’s make 2025 the year we take the world by storm together!

Thank you to each and every one of you for reading this letter, whether you are my client, colleague, partner, friend, or follower. SERHANT. would not be possible without you.

Please let me know your feedback, and as always, Happy Holidays and cheers to a prosperous and exciting New Year!

Ryan Serhant

Founder and CEO

SERHANT.

December 19th, 2024